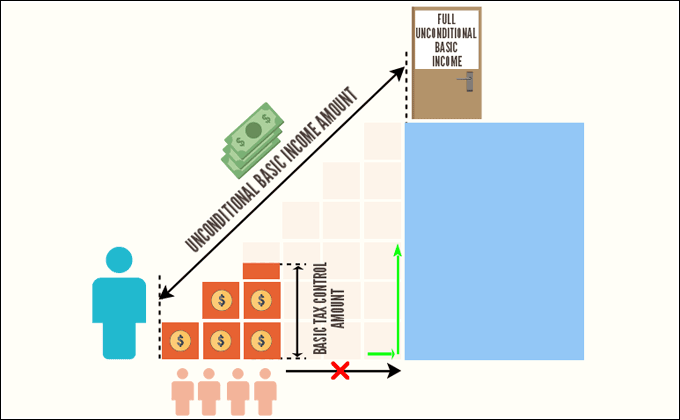

We can think about Basic Tax Control as a staircase to the door on the first floor. Doors on the first floor represent the minimal amount needed to be able to give Universal Basic Income to everyone. Each step represents a portion of money dedicated for Basic Tax Control, and the height of the step represents the amount of money that was returned to the UBI fund from investments. The number of steps we need to build and the path we need to travel are not known at the beginning, but it would be possible to estimate what it would take to get there. Every step we build will lift us higher, but only if it’s done in the correct way. If we build stairs aligned like floor tiles, we will never get there.

The main purpose of the Basic Tax Control online platform is to make this transfer happen gradually, from our current society to one that is not moneyless but is organised in a way in which no one needs to worry about basic needs.

There are two natures of our being one is personal and the other is social. Each has its own needs to be satisfied, in order to survive. So, there are physical and social requirements. Universal Basic Income is envisioned as a system that will satisfy our personal needs; the Basic Tax Control is there to satisfy the needs of our society and, through those needs, build the path toward satisfying our basic personal needs.

In that context:

-

Basic Tax Control is a societal income dedicated to individual people, so they can spend it investing in companies that give back portions of profits into a public fund.

Universal Basic Income is personal income. - Basic Tax Control does not exclude the existence of Universal Basic Income; in fact, BTC makes it possible to implement UBI sooner.

-

Both systems are funded from taxes (money collected from the public for public purposes).

-

Basic Tax Control has rules.

Unconditional Basic Income is unconditional, no rules and no strings attached. -

Basic Tax Control includes only people who are literate enough to participate in it.

Unconditional Basic Income is given as a birthright, regardless of age, sex, knowledge, race, etc. -

Basic Tax Control can be implemented with a very small amount of money.

(For BTC, we would need as little as 0.5% of total collected taxes in UK for ~57 million people)

Unconditional Basic Income requires enough money to cover basic survival needs of all people.

(If we take ~£1000 per month for each of the 64 million people in the UK, we would need roughly 119% of total collected taxes).

(* Calculation made in view of total taxes of £ 648.1 billion*1 in UK for 2014)

-

Basic Tax Control - everyone invests and works together. However, each person can manage his/her own funds in whatever way he/she likes (just like they would use their votes during elections).

Unconditional Basic Income - you mange on your own money in whatever way you like. -

Basic Tax Control – funds should not be used for charity. Charity is something you would finance from your personal funds. Basic Tax Control has a well-defined purpose.

Unconditional Basic Income – does not limit how you spend your money. You can spend it on charity or alcohol or whatever else you want; it is your choice. -

Basic Tax Control – is the way to democratically influence positive changes with dedicated funds or by participating in online debates.

Unconditional Basic Income – gives you enough time to become whatever you want. You can become an activist or volunteer for causes and help to create a better society. It is completely yours to choose. -

Basic Tax Control – the platform is technologically supported and relies on online and mobile technologies .

Unconditional Basic Income – is paid to your bank account; from there, you do with it whatever you want. -

Basic Tax Control – does not require extra fees or taxes per transaction, because funds can be virtually managed until the point they were transferred to the companies.

Basic Tax Control – can be used as a tool for increasing wealth by investing in sustainable technologies that can help us fix both global and local issues. - Basic Tax Control – the best way to use it would be investing in the projects and companies that give back the highest guarantied portion of investment returns.

-

Lastly, Basic Tax Control can be boosted by wealthy people; they can pledge their companies to public fund like a form of inheritance or legacy. They can also directly donate a portion of their company’s shares into the fund.

However, not every company should be allowed to participate. If a public committee decides that the company worked fraudulently or has a previous bad track record showing a detrimental impact on people or the environment, those companies should be banned from any type of participation in the BTC schema.

Comments